In the dynamic landscape of modern business, efficiency is key to staying competitive. One area where this is particularly crucial is payroll management. Handling payroll in-house can be a time-consuming and complex task, often prone to errors that can lead to financial repercussions and employee dissatisfaction. As a solution, many businesses are turning to outsourcing their payroll outsourcing processes, finding it to be a smart and strategic move.

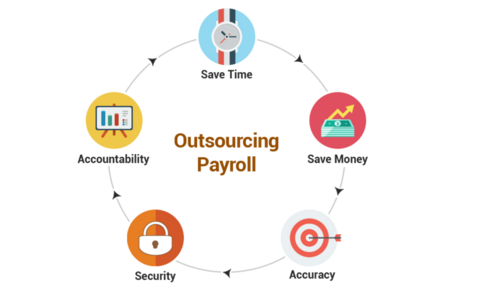

The payroll outsourcingbrings with it a myriad of benefits, the foremost being the reduction of administrative burdens. Calculating salaries, withholding taxes, and ensuring compliance with ever-changing regulations demand meticulous attention to detail. Outsourcing to a specialized payroll service provider allows businesses to tap into the expertise of professionals who are well-versed in the intricacies of payroll management. This not only ensures accuracy but also frees up valuable time for the internal staff to focus on core business activities.

Cost-effectiveness is another compelling reason to consider outsourcing payroll. In-house payroll management involves not just direct labor costs but also expenses related to software, training, and compliance updates. By outsourcing, businesses can convert fixed costs into variable ones, paying only for the services they use. This scalable model allows for flexibility in managing budgetary constraints and adapting to changing business needs.

Moreover, outsourcing payroll mitigates the risk of costly errors. Mistakes in payroll processing, such as inaccuracies in tax withholdings or missed compliance deadlines, can result in financial penalties and damage to the company’s reputation. Professional payroll service providers are equipped with robust systems and processes to minimize errors, ensuring that payroll is executed accurately and on time.

Data security is a growing concern in the digital age, and businesses handle sensitive employee information during payroll processing. Outsourcing to reputable payroll service providers often means enhanced security measures, including encryption, secure data centers, and regular audits. This can provide peace of mind for businesses concerned about the confidentiality and integrity of their payroll data.

The ever-evolving landscape of tax regulations and compliance requirements adds complexity to payroll management. Keeping abreast of these changes is a demanding task. Outsourcing payroll to experts who specialize in staying current with regulations helps businesses navigate the intricacies of tax laws, minimizing the risk of non-compliance and associated penalties.

Employee satisfaction is closely linked to timely and accurate payroll processing. Delays or errors in payment can lead to dissatisfaction and negatively impact morale. Outsourcing ensures that payroll is processed efficiently, contributing to a positive employee experience. It also allows businesses to offer convenient features such as direct deposit, electronic pay stubs, and online access to payroll-related information, enhancing overall employee satisfaction.

In conclusion, outsourcing payroll is a strategic move that can simplify the complexities of payroll processing for businesses. It not only reduces administrative burdens and costs but also minimizes the risk of errors and enhances data security. By leveraging the expertise of specialized payroll service providers, businesses can streamline their operations, stay compliant with regulations, and ultimately focus on their core competencies, fostering a more efficient and competitive business environment.